Release Notes for 9.10.2015

Release Features Overview

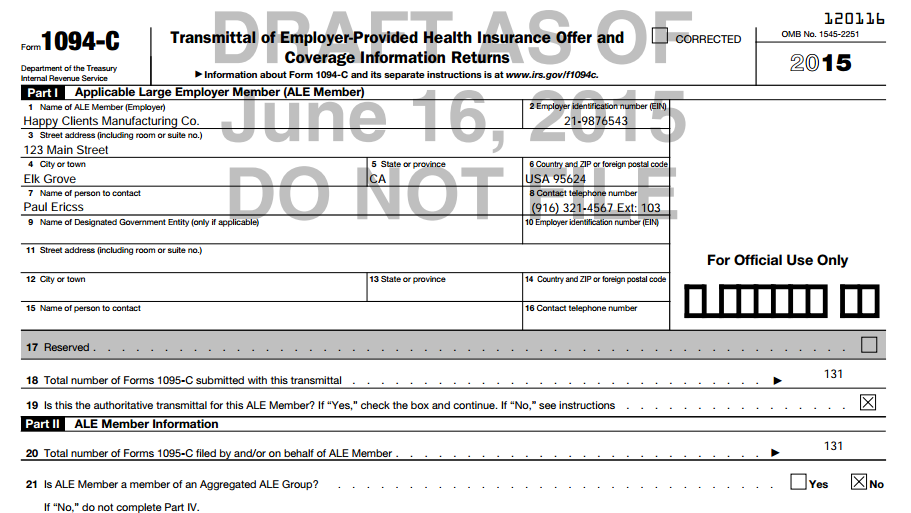

This ACAManager release is possibly one of our most anticipated releases. In preparation for the end of the year ACA reporting we've enhanced our system to include the IRS 2015 drafted versions of the following forms: 1095-c, 1094-c, 1095-b and 1094-b. These forms are currently accessible and available in our Beta mode. Because we are still finalizing the business requirements, data necessities and awaiting the final approval on the 2015 forms, from the IRS; the reporting documents will not be out of Beta review until after that process has been completed.

ACA IRS Employer Forms

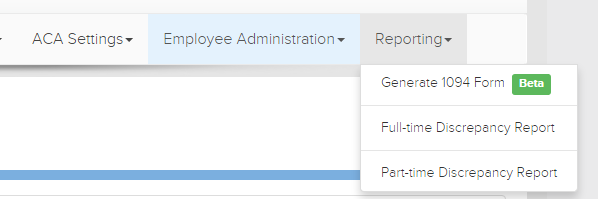

The Reporting section of ACAManager now features the IRS 1094-c and 1094-b forms. The illustration of either the 1094-c or 1094-b form is contingent on the employer's Applicable Large Group (ALE) eligibility and their plans funding status. These business rules are programmed into the system and generated based on the information gathered during the setup process.

By selecting the "Generate 1094 Form" hyperlink, the page will return the appropriate employer report, as displayed in the image below.

ACA IRS Employee Forms

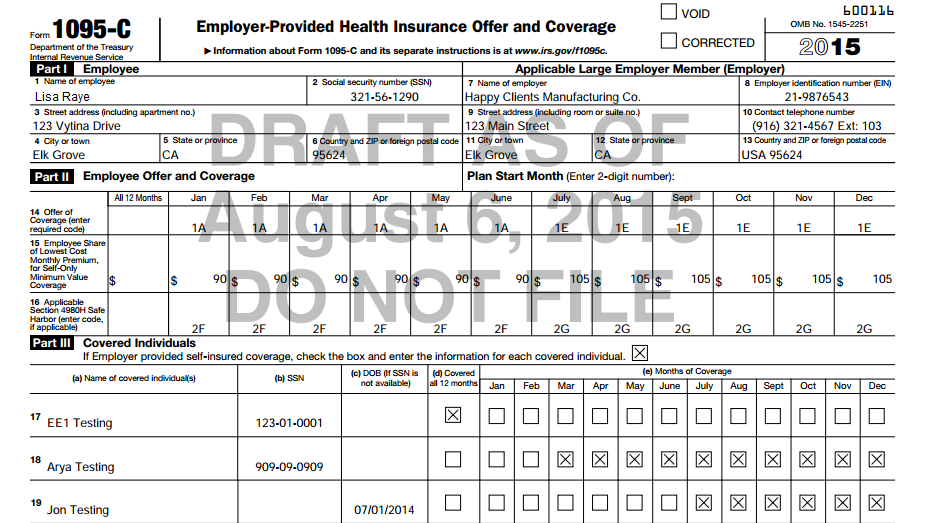

Employees eligible for benefits and covered COBRA and Retirees of an ALE who is should receive a 1095-c. The 1095-b form is identified as the form that for the most part carriers will complete and issue; however for employer groups that are not ALE and are self-insured, those employer's are expected to issue the 1095-b to covered individuals.

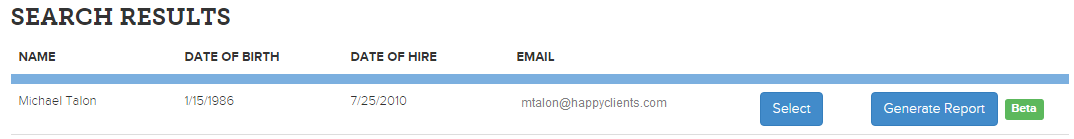

ACAManager provides the 1095-c and 1095-b forms where applicable for employees. These forms are accessible via the Employee Search menu as well as the Employee Profile. At this time employee forms can only be viewed and retrieved one at a time; mass download options are being assessed and may be available once the forms are out of Beta.

When searching for an employee within ACAManager, you will be presented with an opportunity to view the respective employees report by clicking on the "Generate Report" button.

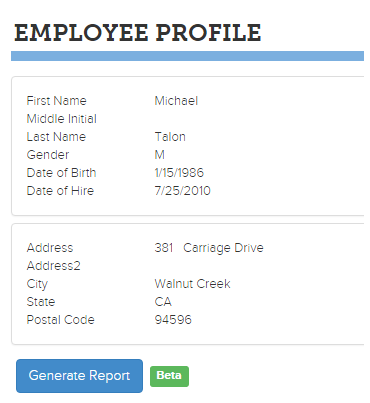

As illustrated below, the Employee Profile also houses the employee specific IRS form.

By clicking on the "Generate Report" button you will be presented with the appropriate 1095 form and shown data specific to the selected employee.

Updated less than a minute ago