Forms and Reports

ACA IRS Employer Forms

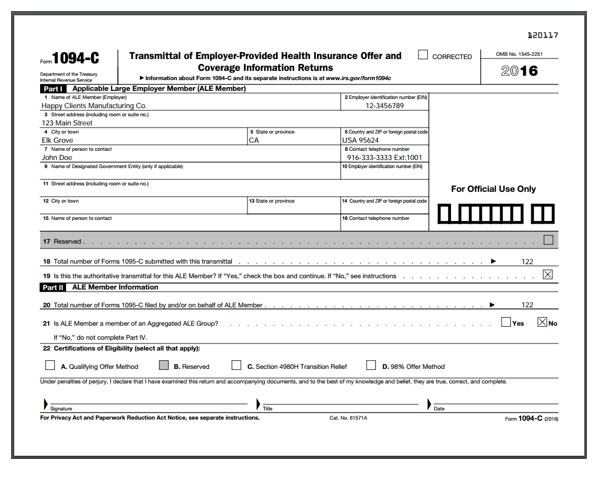

The Reporting section of ACAManager now features the IRS 1094-B and 1094-C forms. The illustration of either the 1094-C or 1094-B form is contingent on the employer's Applicable Large Group (ALE) eligibility and their plans funding status

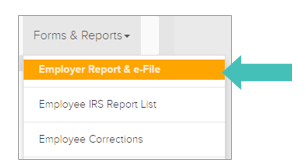

- Select the Employer Report & e-File.

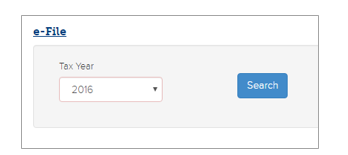

- Select the Tax Year and click Search.

- You are able to Edit and/or Download the Employer Report. Using the Edit function, you can make changes to the form without making any changes to your existing data.

Note: Once the information has been edited, there is no way to restore the default information generated by the system. If you are unsure of the best way to make the changes you would like to see, please contact your Account Manager.

Employee IRS Report List

You can view a list off all of the company's employees and list of forms created for a given year by utilizing the Employee IRS Report List

- Choose the Employee IRS Report List from the Forms & Reports drop-down menu

- Choose the desired year from the Tax Year drop-down

- Use the search criteria to filter the report

a. First Name

b. Last Name

c. Division

d. Status

- Select Search (1) and then Download (2)

Email Only Selected Employees 1095 Forms

- Use the Employee IRS Report List to select only select employees or choose "email all"

- Press Email Selected

Employee Correction List

If there are errors to the IRS e-file, the employee errors will be visible through the Employee Corrections report.

- Choose the Employee Corrections report from the Forms & Reports drop-down menu

- Select the desired Tax Year (a) and the desired Division (b)

- Select Search (1) and then Download (2)

Updated less than a minute ago