ACA Code Cheatsheet

This information is not tax or legal advice. Employers are encouraged to read the instructions and forms in their entirety and work with trusted advisors to prepare any IRS documents.

The IRS has created two sets of codes to provide employers with a consistent was to describe their medical benefit offerings to their employees. Each code indicates a different scenario regarding an offer of coverage, or explains why an employer should not be subject to a penalty for an employee, for each month.

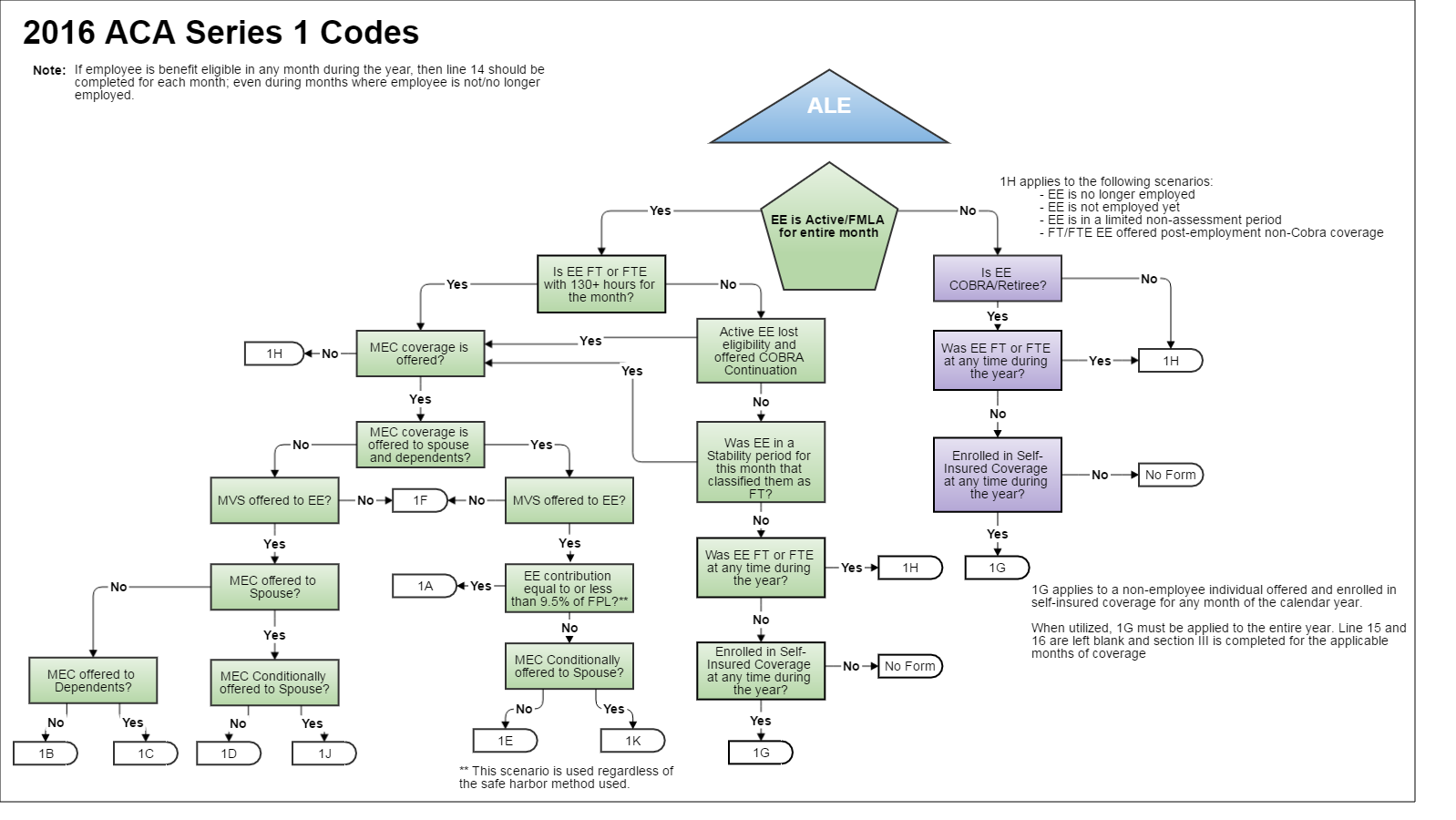

Form 1095-C: Line 14 - Code Series 1

Code Series 1 is used for Line 14 of Form 1095-C and addresses:

- Whether an individual was offered coverage

- What type of coverage was offered

- Which months that coverage was offered

If an employee is benefit eligible in any month during the year, then line 14 should include a value for each month, even during months where an employee is not/no longer employed.

Important Note Regarding Affordability: References to affordability relate to affordability at the employee-only coverage level. It does not matter if the employee elects coverage for him or herself and a spouse or dependent. The IRS is only concerned with what the employee would have to pay if he or she elected coverage for him or herself alone.

*Offer of Coverage: An offer of coverage is one that provides coverage for every day of a calendar month. There is an exception for terminated employees who would have been covered for the entire month, if not for the termination.

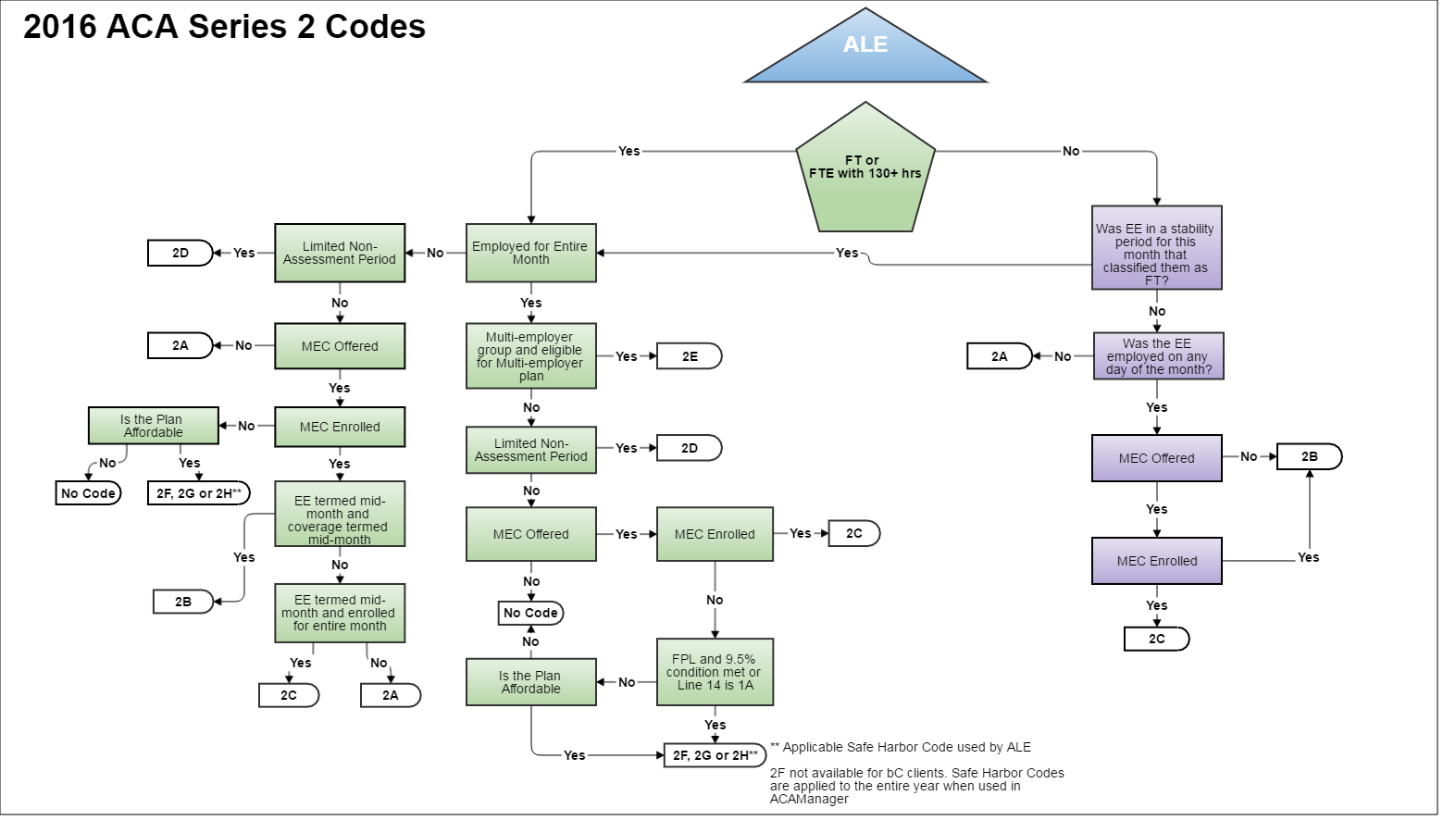

Form 1095-C: Line 16 - Code Series 2

Code Series 2 is used for Line 16 for Form 1095-C and address:

- Whether the individual was employed and, if so, whether he or she was full-time or part-time

- Whether the employee was enrolled in coverage

- Whether the employer is eligible for transition relief as an employer with a non-calendar year plan or as a contributor to a union health plan

- Whether coverage was affordable and, if so, based on which IRS safe harbor

Updated less than a minute ago